April 01, 2019

U.S. Sees Gains In Consumer Sentiment, Manufacturing Output

Construction spending was up too, but retail sales weakened.

Consumer sentiment and manufacturing output in the U.S. both rose in March, while construction spending increased in February, according to recently released separate reports. Meanwhile, American retail spending slumped in February, but was still stronger than the same month a year ago, a federal analysis showed.

Such data can provide insight into the possible strength or weakness of the American economy – important information for the promotional products industry, whose fortunes often correlate to the relative strength of GDP.

The University of Michigan’s closely-watched Index of Consumer Sentiment rose nearly 5% from February to a March reading of 98.4. While that was down 3% from the same month a year ago, it was still better than the average score of 97.2 recorded over the last 26 months.

The 4.6 point gain in U.S. consumer sentiment this month was the highest since October 2017, when the index jumped 5.6 points to 100.7. https://t.co/p7lvF6idSe

— Real Time Economics (@WSJecon) March 29, 2019

The University of Michigan’s related Current Economic Conditions Index jumped 4.4% month-over-month to 113.3 in March, though that was down 6.5% from March 2018. The Index of Consumer Expectations rose more than 5% to 88.8 in March 2019 – flat with the previous year’s reading.

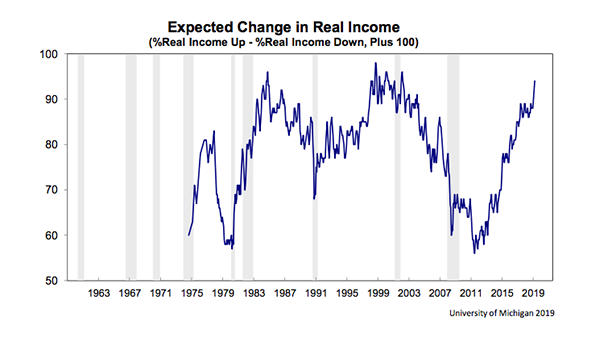

“The March gain in the sentiment index was entirely due to households with incomes in the bottom two-thirds of the income distribution posting a gain of +7.1 index-points,” University of Michigan researchers said in a statement. “The last time a larger proportion of households reported income gains was in 1966…Overall, the data do not indicate an emerging recession, but point toward slightly lower unit sales of vehicles and homes during the year ahead.”

Meanwhile, manufacturing activity in the U.S. in March outpaced the expectations of economists. On Monday, the Institute for Supply Management (ISM) revealed that its index of national factory activity rose from 54.2 in February, the lowest level since November 2016, to 55.3 in March. Economists had expected a score of 54.5.

Readings above 50 indicate that the manufacturing sector is expanding. Readings below 50 indicate contraction. Relatedly, ISM said its index on new manufacturing orders rose from 55.5 in February to 57.4 in March. The employment index was up more than five points in March to 57.5, while the production index rose a point to 55.8.

@ISM: Manufacturing activity bounced back from its lowest point since Nov. 2016 in Feb. to reflect continued modest expansions in the sector in March. Exports were soft, but overall, manufacturers cite improvements, especially relative to the weaknesses at year's end. pic.twitter.com/uzcAalJcMk

— Chad Moutray (@chadmoutray) April 1, 2019

In another report released Monday, the U.S. Department of Commerce said that construction spending rose 1% to a nine-month high in February after an upwardly revised 2.5% increase in January. Construction was up 1.1% year-over-year, and the February performance beat the expectations of economists, who had predicted a 0.2% decline. Gains in private and public sector construction projects fueled the February increase.

February ‘19 total #construction spending $1,320.3b (annualized), up 1.0% from January and up 1.1% from February ‘18 $1,305.5b https://t.co/TkHg63EXon #Census pic.twitter.com/6dXEC3tjDh

— U.S. Census Bureau (@uscensusbureau) April 1, 2019

In another data set, the Commerce Department said Monday that retail sales declined 0.2% as Americans tightened spending on furniture, clothing, food, electronics, appliances, building materials and gardening equipment. Even so, retail sales were still up 2.2% from a year ago. Additionally, the Commerce Department revised January data to show that U.S. retail sales rose 0.7% instead of the 0.2% increase previously reported. Delays in processing tax refunds and smaller refunds might have contributed to the weaker retail sales showing in February 2019.

Retail spending declined by 0.2% in February, continuing to reflect softer retail sales than desired since the end of last year. On the other hand, Jan. retail sales were revised higher, up 0.7% instead of the original estimate of a 0.2% gain. Retail sales were up just 2.2% YOY. pic.twitter.com/F0pOkxqJvz

— Chad Moutray (@chadmoutray) April 1, 2019

According to some analysts, recent monthly reports like these and others suggest that GDP growth might have slowed in the first quarter of 2019 amid the trade dispute with China, the now-ended partial federal government shutdown, market uncertainty over the looming Brexit, and a wind-down in the momentum from last year’s tax cuts and increased government spending. Nonetheless, the data would also suggest that the American economy is continuing to grow and is not about to slip into recession, some economists said.