April 27, 2021

Promo Sales Decline Nearly 15% in Q1

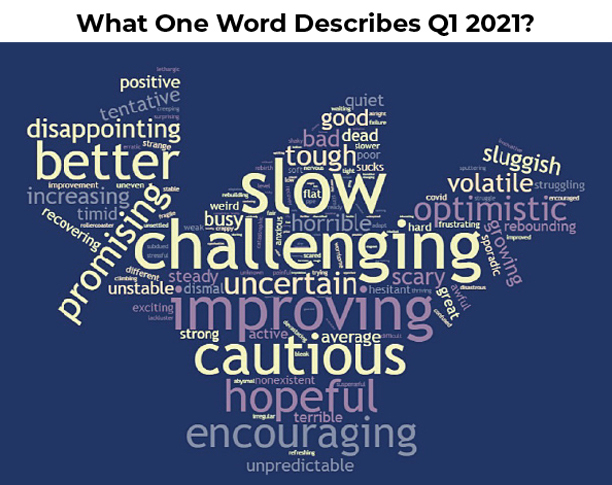

Despite a challenging quarter, distributors are optimistic for a pronounced rebound for the rest of 2021.

Stran Promotional Solutions (asi/337725) hustled hard in the opening months of 2021, but the Quincy, MA-based distributor’s sales still declined about 19% year-over-year in the first quarter.

“Q1 2021 sales were affected by businesses not being fully reopened, as well as a lack of in-person events,” says Howie Turkenkopf, Stran’s vice president of marketing. “At the same time, the boost that we saw in Q2 and Q3 of 2020 from sales of personal protective equipment has slowed significantly, as there’s less need for new or more PPE.”

In many ways, Stran’s story is emblematic of the Q1 experience for distributors throughout the promotional products industry.

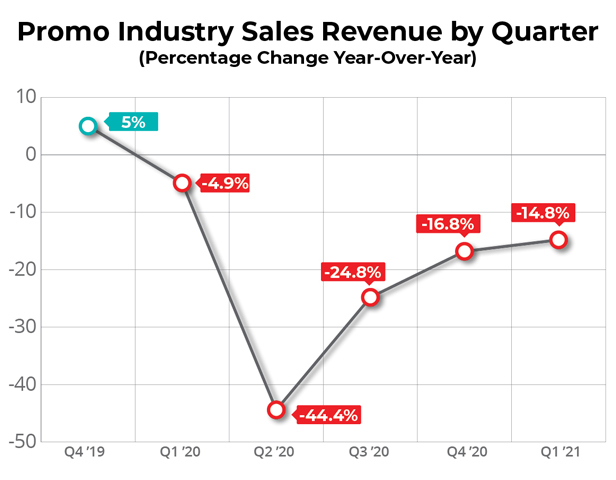

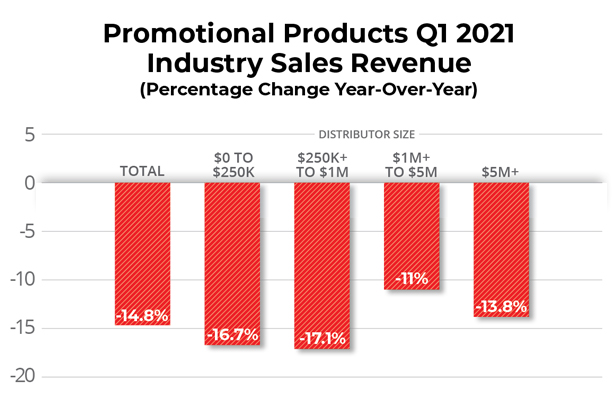

Continued COVID-19 complications, a drop-off in sales of PPE, supply chain woes and pricing pressures – they all resulted in distributors’ sales declining, on average, by 14.8% in the first quarter of 2021 compared to Q1 2020, according to the just-released ASI Distributor Quarterly Sales Survey.

The 2021 first quarter decline marked the fifth straight quarter that distributors’ sales retreated year-over-year – a COVID-driven down streak that followed more than a decade of consecutive quarterly increases.

Of course, the results were not surprising. Industry executives believed it was going to be an uphill battle for Q1 2021 to beat 2020’s performance given that, during the first 10 or so weeks of last year, industry sales were strongly trending up and not yet affected by the economic repercussions of the coronavirus.

Despite the decline, there’s a current of optimism that business conditions, and thus sales performance, are poised to improve significantly in 2021 amid wider-spread societal reopening and accelerated vaccination rollout.

In a Facebook Live video, ASI President and CEO Tim Andrews updated the industry on Q1 sales, ASI’s first large in-person trade show since the COVID crisis began (taking place July 13-15 in Chicago), and much more.

“We’ve been quite busy since the beginning of the year with RFPs and inquiries from customers, which leads us to feeling that companies are starting to prepare to spend again,” says Turkenkopf. “There will be some short-term struggles, but by Q3 and certainly in Q4 there will be a lot of pent-up demand that we expect to compensate for slower earlier numbers.”

A Challenging Quarter

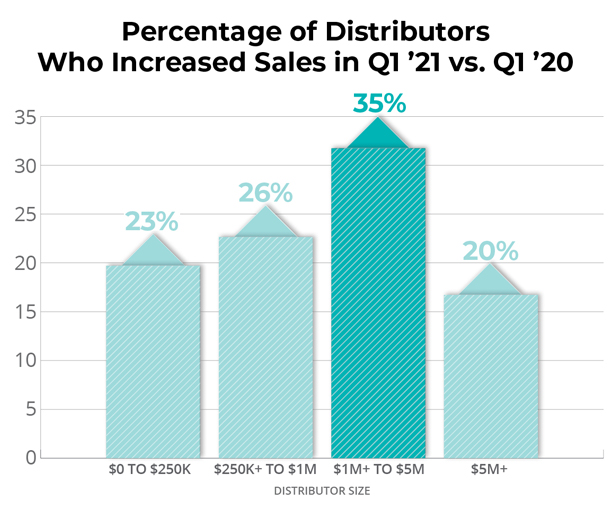

Overall, nearly two-thirds of distributors (65%) reported a sales decline in Q1 this year relative to the same three-month period last year. Still, that was an improvement over Q4 2020, when 73% said their sales fell.

In the quarter, larger distributors fared slightly better than small ones. Distributors with annual sales of $1 million to $5 million weathered the quarter the best, with an 11% average decrease. Mid-size firms between $250K and $1 million had the biggest average decline with 17.1%. The disparity of results between distributor sizes shrunk from 2020, where there was a nearly 20 percentage point gap between large (-15.3%) and small distributors (-33.1%).

“January and February 2021 were slower than anticipated,” says Jo-an Lantz, president/CEO of Lewiston, ME-based Top 40 distributor Geiger (asi/202900). “In November and December 2020, we saw a sales surge. That pent-up demand to recognize employees, spend year-end budgets and thank clients created a bit of an early-year hangover.”

During the opening weeks of the year, COVID-19 cases were surging and tighter societal restrictions were in place. The surge eased and restrictions loosened, but COVID still continues to have a grip on key outlets for promo sales. “The cancellation of trade shows, events, and many after-school activities and sports are what drove our performance down,” says Steven McKee, owner of Heritage Screen Printing, which dealt with a 40% year-over-year Q1 sales plummet.

In total, 26% of distributors increased sales in Q1, more than in 2020 Q4 (19%) and Q3 (13%).

During 2021’s first quarter, soaring shipping costs, lack of shipping container availability and rising raw material prices conspired to cause supply chain disruption that resulted in inventory shortages and increased prices on promo products.

Such factors impacted distributors’ ability to do business, respondents recounted time and again in ASI’s quarterly sales survey. “It was very hard to complete sales as most inventory was low,” one distributor said. Another added: “Inventory availability declining and shipping delivery issues remain causes for concern.”

Many distributors also said sales were down in a key category. “Sales of PPE have definitely declined,” says Jeff Golumbuk, owner of San Diego-based Custom Logos (asi/173183), which generated about 20% of its 2020 sales from the category. PPE sales propped up many distributors in Q2 and Q3 last year, but its absence in 2021 negatively impacted many companies.

Surpassing Expectations

Notably, the Q1 headaches don’t seem to have come as a surprise. Nearly 4-in-10 (38%) distributors reported that their first quarter sales exceeded expectations, while another 35% say sales were about what they expected. “After a busy fourth quarter, we were really busy in the first quarter too, with new and larger projects than we expected,” a distributor commented in ASI’s survey.

For sure, there were success stories in Q1.

San Francisco-based KK Promotions, an affiliate of Top 40 distributor Proforma (asi/300094), engineered year-over-year sales increases in the first quarter and in the month of April. “We had four straight over-$100K months, which is a great start for us,” says owner Kimberly Karp, who counts two sales pros and one admin as part of her team. “Our good clients never went away, and we started the year strong.”

So did Sunday Print Co. The decorator/distributor, a small screen printer based in Los Angeles, increased revenue about 10% year-over-year in Q1. “A lot of it was just people getting back to normal business,” says owner Tim Guza. “I also think the pandemic sparked people to start some new, creative projects, which we were able to help them with.”

New York City-headquartered Whitestone Branding (asi/359741), which has a remote workforce with personnel around the United States, executed a 20% increase in sales in Q1 2021 compared to the same timeframe in 2020.

“Our growth is a reflection of our team’s hard work prospecting with new companies, but even more so it’s a result of having stayed in touch with clients throughout the pandemic,” owner Joseph Sommer explains. “We’ve been nurturing a lot of people who might have been let go from previous employers. They’ve then been hired by new companies, and we’ve been able to start new relationships with those businesses.”

Hot Markets

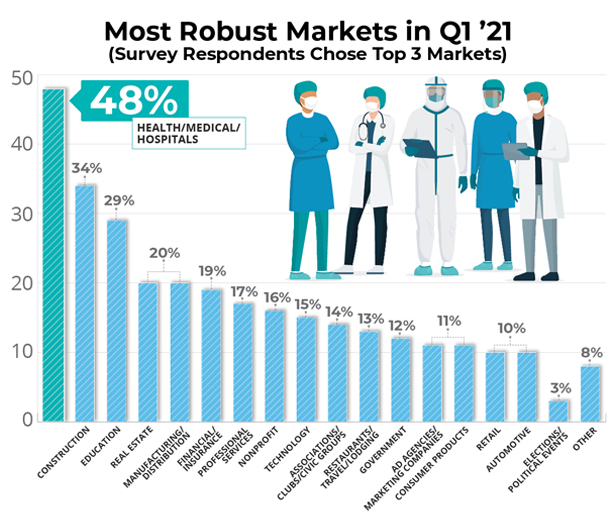

Industry-wide, these three markets stood out as the most robust for promo sales in Q1: healthcare, construction and education.

Where each particular distributor found the most success varied somewhat based on their client base and focus. Sommer reports that Whitestone saw the greatest opportunities in end-markets that included education, technology, finance and beauty.

Adds Stran’s Turkenkopf: “We experienced success in the healthcare, beverage and technology verticals.”

Lantz relates that pet care, construction, banking, healthcare, distribution, retail food service, quick-service drive-up restaurants and home exercise were all relatively strong performers for Geiger. “Think of the activities you’re doing or investing in right now,” says Lantz. “They’re all the growth markets.”

“Beverage businesses of all kinds have been extremely strong for us,” notes Karp. “Technology was good, too – software firms, biotech. One of my tech clients went public. With the IPO, the company did packaged goods for all its employees.”

Some distributors gained sales traction in verticals that others described as relatively weak. “Automotive and hospitality were good for us,” McKee shares.

Others keyed-in on highly specific niches to stoke sales. “We’ve had great success with skateboard shops,” says Guza. “I have a few shops as clients that I have a good relationship with, and they’ve done really well with the pandemic forcing people to find outdoor hobbies.”

Looking Ahead

Building on that positive note, Guza feels confident that Sunday Print Co.’s full-year 2021 sales will surpass that of 2020.

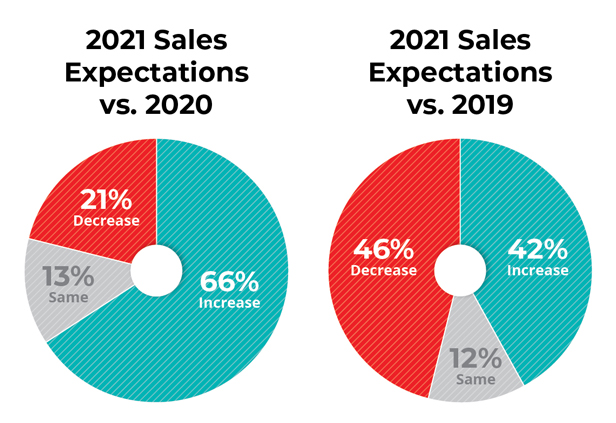

He’s far from alone in those thoughts. A full two-thirds of distributors expect 2021 sales to exceed the prior year. “There’s nowhere to go but up,” says Lantz. “We will end the year strong. As a business, we’ll be stronger than ever.”

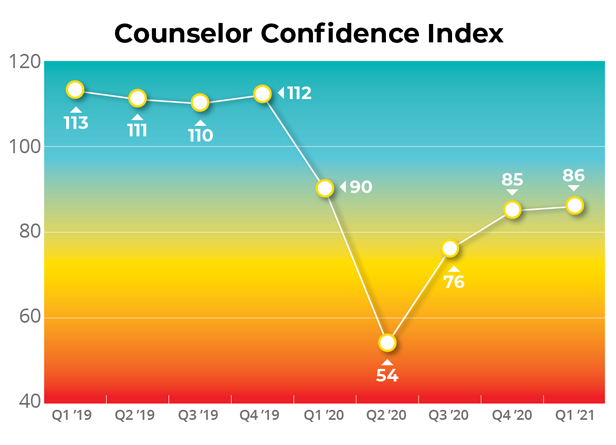

The belief in a better 2021 helped the Counselor Confidence Index, which measures distributors’ financial health and optimism, rise to its second highest level since the pandemic began, ticking up from 85 in Q4 to 86 in Q1. While that’s below the baseline reading of 100, it’s far better than the historically low tally of 54 seen during the second quarter of 2020, suggesting that while they may not be buoyant, distributors do foresee progress. “This year will be much better for us compared to 2020,” says McKee.

Many distributors feel societal reopening should create more opportunities as live events return to an extent and as life renews in hospitality. “Hospitality is starting to perk up,” Lantz notes. “The same is happening with sporting events and events in general. We see demand and growth in the third and fourth quarter.”

While there’s confidence for 2021 business, distributors are about evenly split on whether or not sales will match/surpass or fall below pre-pandemic levels this year. ASI data shows that more than half of distributors (54%) believe their 2021 sales will increase relative to 2019 – a year in which distributors’ collective revenue set an all-time industry record of $25.8 billion. Compared to the first quarter of 2019, Q1 industry sales were down 18.9%.

“I would be shocked and pleasantly surprised if our 2021 sales exceed 2019,” says Golumbuk. “I think that in of itself will be difficult, but not impossible.”

The fact that distributors are realistically contemplating year-over-year sales increases and possibly outpacing what was an excellent year in 2019 is a sign of progress. There’s a feeling that a corner has been turned, says Nate Kucsma, ASI’s executive director of research and corporate marketing.

“The industry,” Kucsma shares, “faced some strong headwinds in Q1, including inventory shortages and a continued slow build back to normal. Still, there are certainly signs of optimism as we enter Q2, including the reopening of events and travel coming back strong, both of which should push this recovery forward in a big way.”