The hectic fourth quarter is upon us. And while supply chain issues made a crazy quarter even more chaotic in recent years, those conditions seem to have largely improved in 2023.

But there’s a new challenge to contend with – economic malaise. Even as distributors grew their quarterly sales in Q2 2023 for the ninth consecutive time, the Counselor Confidence Index fell from 104 to 101. Factors included ongoing logistics uncertainty – like the recent port strike in Canada and a narrowly-avoided UPS strike in the U.S. – as well as increasing costs, like raw materials, shipping, credit card processing fees and labor. Inflation is still having an impact on purchasing ability among end-buyers in various industries.

“Everyone’s nervous. There’s a lot of uncertainty and clients have reeled in their budgets.”Andrew Haslam, Grossman Marketing Group (asi/215205)

Those headwinds are tempering expectations for what’s normally distributors’ most anticipated quarter. Of distributors surveyed by ASI, 45% predicted their Q4 sales will be about the same this year compared to 2022, while 35% said they’ll be “somewhat better.”

Like always, clients will continue to give gifts this year to keep their branding top-of-mind – but their buying habits are likely to shift in response to a variety of factors. Here’s a snapshot of current consumer sentiment and predictions of the types of products end-buyers will be looking for in Q4.

Contending With Economic Woes

There’s some debate as to whether the economic uncertainty distributors saw in the first half of the year will impact Q4 sales. Brian Porter, CRO of Top 40 supplier Starline (asi/89320), says he anticipates numbers will grow in Q3 and Q4. “The economy is in a good place overall,” Porter maintains. “The consumer price index is coming down, markets are moving up and companies have money to spend, so we’re bullish on the fourth quarter. It’s going to be another very strong finish to the year, matching what we’ve seen the past two.”

David Miller, president of Top 40 supplier NC Custom (asi/44900) and a member of Counselor’s Power 50 list of the industry’s most influential people, says he too is confident about the upcoming quarter – his team was already fielding holiday gift requests as early as July (incentivized, no doubt, by a first-time early ordering special for U.S. distributors that the company had previously implemented in Canada). “There’s no one end-market that’s specific for Q4 gifts,” says Miller. “They’re purchased by all end-buyers – they’re a way to thank clients for past business and stay top-of-mind for new opportunities in the next year.”

Distributor Expectations for Q4 2023

(compared to Q4 2022)

(ASI Research)

Others say increased prices have become part of the purchasing landscape; after several years of inflation, clients these days are less likely to balk. “Costs have gone up on ingredients and labor and we’ve already communicated those increases so it’s not a surprise in Q4,” says Eileen Spitalny, co-founder and sales & PR team leader at Fairytale Brownies (asi/53518). “At the same time, we’re encouraging customers to buy early.”

Orders may be smaller this year, says Michael Bistocchi, CRO at Top 40 supplier Logomark (asi/67866), but he expects order volume to be up. “Demand for products is still strong,” he says. “The media puts the scare in people, but bigger companies know how to plan. Small- and medium-sized businesses might be teetering a bit, but they’re still purchasing.”

Gina Barreca, director of marketing at Top 40 supplier Vantage Apparel (asi/93390), is also bullish for the coming season. Despite economic headwinds, demand for high-end apparel ramps up each year. “The number of single-piece orders always goes up in Q4 and there’s more drop-shipping,” she says, “though we’ve seen a shift back to more in-person distribution in recent months.”

Still, distributors say clients are concerned about where the economy is going. Andrew Haslam, account executive at Grossman Marketing Group (asi/215205), says online store business, which boomed during the pandemic, has slowed significantly this year. Tech and renewable energy companies, which make up a lot of his portfolio, were “hiring like crazy” in recent years; now they’re pulling back some, especially after large-scale layoffs this spring, and that’s impacting their spend.

“Clients are cutting budgets and not hiring as much, and those two things drive the projects we do,” says Haslam. “Everyone’s nervous. There’s a lot of uncertainty and they’ve reeled in their budgets. We’ll see things pick up in Q4, hopefully. But clients are now more conservative.”

Inflation across the board has put downward pressure on end-buyers, notes Lisa Goldberg-Belle, owner and president of It’s a Wrap Gifts and Promotions (asi/229662). They’ve been shying away from increased costs on products and freight. “There’s still talk of a recession on the horizon and we’re expecting interest rates to go up more,” she says, “so people are apprehensive.”

of suppliers’ sales take place in Q4

(ASI Research)

Brett Boake, general manager of Toronto-based SCORE Promotions (asi/321353), notes that in Q3 of 2022, some customers halted planned projects, saying that executives had decided to spend budgets on events instead. Now, a year later, they’re back to branded products, though Boake says Canadian clients are more cautious than those in the U.S.

Sentiments are also industry-dependent. While it’s “full steam ahead” for some customers, like alcohol brands and cosmetics, it’s more of “a teeter-totter” for finance, explains Boake. “Loan companies are being cautious,” he says. “During our 2023 vision meetings in December 2022 and January 2023, they were very optimistic. By the middle of Q2, they had pulled back. Mortgage companies are slamming on the brakes and automotive has also slowed, because of the high interest rates.”

Steve Schneidman, president of Solutions Ink (asi/525994), says in Quebec the feeling is the same. Larger clients that are doing well will order gifts for clients and staff as usual. SMBs will also be gifting, but they’ll be tightening their budgets and going for smaller order sizes or less-expensive items. “It just won’t be as elaborate as last year,” he says. “They’re planning for the worst and hoping for the best.”

Must-Know Product Trends

Despite some pullback in certain industries, promo companies say gifting will continue this year – even if purchasing habits shift. Haslam anticipates more conservative order sizes of items at a higher price point. “We’ll likely do smaller orders of $100 Patagonia fleeces, when before our sweet spot was $10 to $30 an item,” he says. “Clients are going to be more thoughtful with their spend.”

Retail products will continue to do well this year among bullish clients, says Daniel Siegel, director at Industrial Contacts (asi/231220). “End-buyers want to align with the high perceived value of those brands,” he says. “The names are highly recognizable and offer a sense of prestige.”

“End-users tend to appreciate themed kits that combine food and hard goods. They’re really sticking right now. And it’s a good idea to thank employees’ and clients’ families as well.”Brett Boake, SCORE Promotions (asi/321353)

Siegel’s also seen growing demand for custom private label items, particularly among clients in fashion, beauty, wellness and tech. “We’re able to create totally bespoke products and gifting experiences,” he says. “We focus on every detail to drive end-user engagement and connection. There’s exclusivity – consumers are attracted to something that’s distinct, special and can’t be found elsewhere.”

Mike Harmon, owner of Harmon Sportswear (asi/219999), has a number of local education clients whom he says are already planning to purchase premium apparel for employees. “Each department head buys items like polos and pullovers for staff,” he shares. “Nearly all of my education customers do some type of high-end apparel.”

End-buyers appreciate high-quality, functional outerwear with performance properties, says Barreca. She suggests unique decoration placements, like on the lining, hip or lower placket. A tone-on-tone imprint offers more subtle branding.

“We take our cue from retail trends, like combining neutral tones such as saddle and camel with gray and ivory,” she says. “While it was comfort-first during the pandemic, tastes have shifted to items appropriate for the communal office that are also comfortable for wearing after hours.”

3 Ways to Overcome Buyer Reluctance

With ongoing economic uncertainty, some end-clients might be apprehensive this year about doing their usual Q4 gifting campaigns. Here’s how to guide them through the process and save the sale.

1. Schedule time to talk.

Some clients might be gung-ho about doing the same yearly gift, while others may be rethinking their projects. Instead of asking them to let you know when they’re ready to put their annual order in, have frank discussions about their budgetary situation this year and help them plan accordingly. That demonstrates that you recognize the economy has been tough on a number of industries.

2. Think good/better/best.

If your clients are planning to pull back this year, give them several product alternatives. Shop around, talk to your preferred suppliers and find comparable products at different price points. Instead of clients cancelling their gifts this year, they’ll appreciate options that are similar to their normal projects that may be easier for them to handle from a budgetary standpoint.

3. Find a good deal.

Leverage your relationships with suppliers and freight companies to find the best deals for your clients. Ask suppliers for products on discount and see where you can save on imprint, setup and run charges. And unless delivery is date-sensitive, find out from your courier how you can ship the products in a way that saves your clients money.

Food gifts are a perennial favorite – even with a changing economy, they prove popular year after year and they’re an ideal choice for a large group of recipients since sizing isn’t an issue. “Food tends to be economically resilient,” says Spitalny. “There’s comfort and sharing. It’s a mood-lifter. It encourages engagement among people and makes everyone happy.”

While a general return to communal workspaces means more in-person distribution, kitting will continue to be popular this year. “End-users tend to appreciate themed kits that combine food and hard goods,” says Boake. “Maybe it’s a small bottle of alcohol, gourmet hot chocolate mix and two mule mugs or travel tumblers. They’re really sticking right now. And it’s a good idea to thank employees’ and clients’ families as well – suggest to clients that they find out each person’s family dynamics and include those people and pets in the gift if possible.”

Goldberg-Belle anticipates demand for comfort food bundled with self-care items – like a spa kit or breakfast box with reusable drinkware. Clients also want to buy small and local, in customized packaging. “I had great success last year with 4-inch personal-sized cakes from Mo’s Bundt Cakes (asi/71843),” she says. “The box label can be personalized, which seals the deal with clients. I also still offer fruit baskets – they’re a consistently good seller for me and they’re a healthy alternative to other food gifts. They’re well received everywhere, from office parties to sympathy calls.”

Apparel Essentials

Apparel continues to be a top product category for distributors. According to this year’s Counselor State of the Industry, T-shirts accounted for 17.1% of all sales last year, an all-time high for the category. Garments from tees to polos to outerwear remain a popular choice for Q4 gifting.

Financial firms are sure to enjoy this Patagonia vest (DI-25882) from Driving Impressions (asi/50864).

Help nature centers thank volunteers with this relaxed-fit cotton/poly T-shirt (6600) from Next Level Apparel (asi/73867).

Tour group guides will look fresh in this diamond-textured vest (3135) from Vantage Apparel (asi/93390).

Corporate office staff will want this jersey knit acrylic cardigan (7048) from Edwards Garment Co. (asi/51752).

Hardworking sales reps will appreciate a Nike performance polo (NKDX6684) from SanMar (asi/84863).

A perfect item for hiking club members is this fleece quarter-zip (DG798W) from alphabroder (asi/34063).

Drinkware Must-Haves

Drinkware’s popularity has exploded in recent years. According to this year’s SOI data, it was the second most-lucrative product category behind T-shirts in 2022, accounting for 9.9% of all industry sales. In addition, its market share has increased by 94% since 2008.

For their New Year’s Eve parties, dedicated nonprofit volunteers can impress with an insulated flask that doubles as a Bluetooth speaker (101824-001) from Gemline (asi/56070).

Hospitality staff on their break need a stainless-steel travel mug (SL174PR) from Starline USA (asi/89320).

High school and college clubs can start a new semester by giving students this full-color aluminum bottle (55302) from Hit Promotional Products (asi/61125).

Fitness studios can thank new members with this Pelican tumbler (PL1010) from Logomark (asi/67866).

Stock team stores for the holidays with this impressive stainless-steel water bottle (BTL 129) from Tekweld (asi/90807).

Suggest that tech companies celebrate the end of the year with a thermal tumbler (1600-39BK) from ETS Express (asi/51197).

Coveted Retail Brands

Despite economic headwinds, consumers continue to shop their favorite retail brands. Digital advertising firm Criteo recently found that a third of consumers say they’ll continue to buy name-brand items (which come at a higher price point than generic products) despite persistent inflation. Retail products are hot in promo too, particularly in corporate gifting programs.

Real estate agencies can thank new homeowners with this 51-oz. Bodum cold brew coffee maker (BD-BEAN) from HIRSCH (asi/61005).

Sales teams with reps who exceed quota for the year can distribute personalized Cacharel watches (CCH102) from St Regis Group (asi/84592).

Loyal customers will love to receive an Anker wireless charging stand (PW15) from Custom Charged (asi/47930).

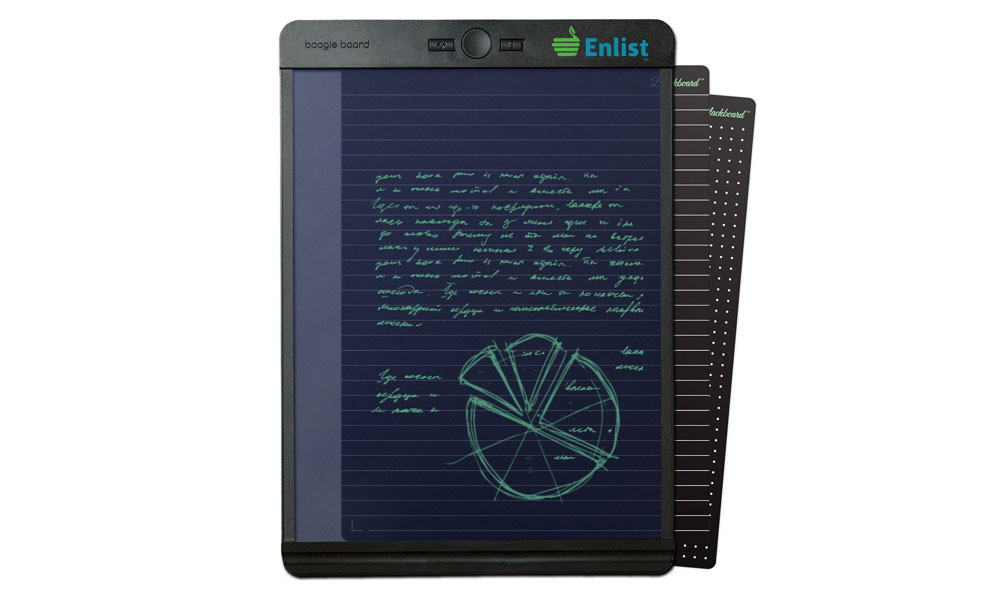

Doctors and nurses can take important notes during their rounds with the app-enabled Boogie Board Blackboard writing tablet (BB-LETTER) from Compass Industries (asi/46170).

Year-end incentive trips to tropical locales aren’t complete without a pair of Prada sunglasses (0PR22ZS-07R0A6) from Links Unlimited (asi/67617).

Contractor staff are sure to use this Zebra pen and mechanical pencil set (ZEBGBF701M701) from Liqui-Mark (asi/67675).

Soothing Self-Care

Even with the pandemic in the rearview mirror, stress continues to be a concern among employees. The American Psychological Association’s 2023 Work in America survey found that 77% experienced work-induced stress in the previous month. The items here express appreciation and recognition for a job well done, which could lessen tension and anxiety.

Gifts at resorts and hotels help guests commemorate their holiday trips, so consider a Sherpa-lined mink throw (DP1731) from Terry Town (asi/90913).

Wellness center clients will benefit from a sleep-in kit (SLEEPIN) containing lip balm, fabric spray, mask and earplugs from HPG (asi/61966).

Sales reps should leave behind this gift tin with chocolate chip cookies and molded chocolate (700-FBTR) from NC Custom (asi/44900).

School administrators would do well to promote relaxation with this tea set box (AA-0LHIV478) from Promoful/PMGOA (asi/79982).

Therapy patients can be encouraged to use a self-care journal (9781454939474) from The Book Company (asi/41010).

Influencer kits are ideal for this branded candle in a gift box (NCSTU8.NS) from SnugZ USA (asi/88060).

Impactful Sustainable Items

Sustainability is fast becoming a non-negotiable among consumers. According to a recent survey by McKinsey and NielsenIQ, socially responsible products accounted for 56% of all consumer retail spending growth since 2017. Promo suppliers are responding to the call with products that contain eco-friendly materials and repurposed components.

Loyal salon and spa clients will love handmade soap on a repurposed wood pallet (UWS5210) from BotanicalPaperWorks (asi/41273).

Sales reps’ business trips are complete with Urbanista solar-powered headphones (URB-LA) from VisionUSA (asi/80060).

Product launch bundles are perfect for a wireless charger made with 35% recycled content (57903) from iClick (asi/62124).

High-achieving college students are sure to use this 15-inch computer backpack made with fair trade-certified organic cotton (9008-01) from PCNA (asi/66887).

Companies can thank dedicated employees with a kit that includes a reverse closing umbrella with RPET canopy (26307) from Koozie Group (asi/40480).

Hardworking environmental volunteers will appreciate an eco-journal with a sugarcane/bamboo cover and FSC-certified pages (BB79) from Chameleon Like (asi/44558).