CANADIAN NEWS October 24, 2024

Infographic: The Supplier-Distributor Relationship in Canada

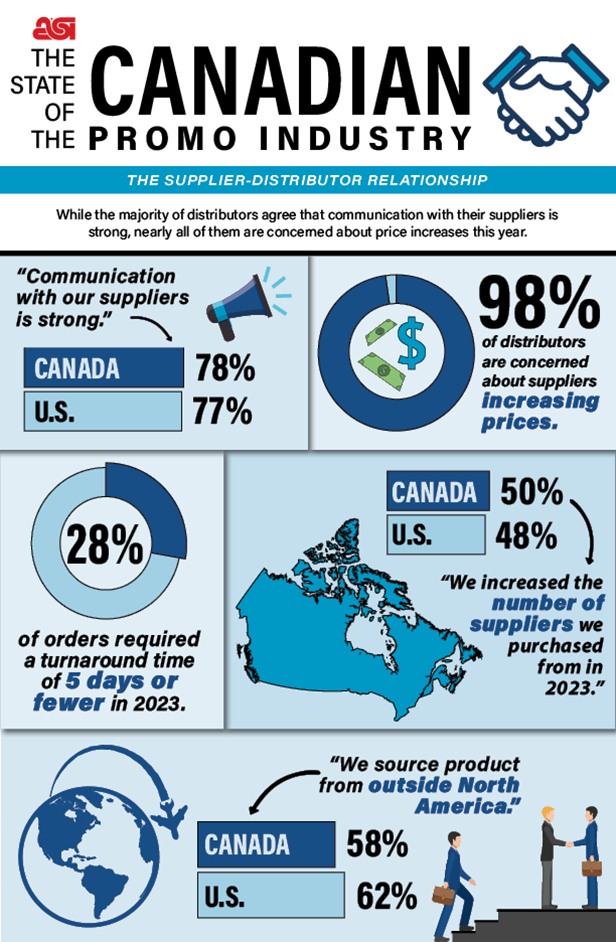

Overall, distributors say communication is strong. Meanwhile, nearly six in 10 say they source a portion of their orders directly from overseas, and nearly 100% are concerned about price increases.

Key Takeaways

• Strengthened Communication: The supplier-distributor relationship in Canada has significantly improved, with most distributors reporting strong communication. This is crucial for managing orders requiring quick turns.

• Adaptability & ESG Focus: Distributors are increasingly fielding end-buyer requests for products that meet environmental, social and governance criteria, and are finding solutions by expanding supplier pools and purchasing from outside the industry when needed.

• Managing Price Increases: Despite rising prices due to factors like labor costs and exchange rates, distributors can mitigate impacts by building strong relationships with suppliers. This strategy enhances purchasing power and helps maintain competitive pricing.

After a tough few years during and immediately after COVID, it seems the supplier-distributor relationship in Canada has continued to strengthen.

According to Canadian State of the Industry data from ASI Research, 78% of Canadian distributors say communication with suppliers is strong, which helps when almost 30% of all orders require a turnaround time of five days or fewer. Half increased the number of suppliers they work with in 2023, though 98% are concerned about price increases. And 58% source product directly from overseas for a portion of their orders.

“Communication has significantly improved over the past few years,” says Sam Singh, president and CEO of Full Line Specialties (asi/199688) in Surrey, BC. “It’s essential that distributors continue to invest in people and resources to further strengthen communication with suppliers and customers.”

Full Line Specialties, a certified B Corp that’s also minority-owned and woman-founded, has also increased its pool of suppliers to meet end-buyer demand for products with an ESG element, which has led to sourcing outside the industry when appropriate, many times from minority- and female-owned businesses.

“Promo suppliers have done an outstanding job of bringing products into the industry that are sustainable, environmentally friendly and ethically manufactured,” says Singh. “But we remain adaptable to meet the rapidly evolving needs of the market.”

Singh also says they’ve definitely seen an increase in demand for quick turnarounds – larger customers frequently have a growing number of people in the purchasing process that have to sign off, while the deadlines remain unchanged.

“Our suppliers do their best to meet the required delivery dates,” says Singh, “but it’s our responsibility as distributors to clearly explain the production process to clients and manage expectations realistically from the outset.”

Finally, Singh says there are obvious reasons why suppliers’ prices have increased, and most of the factors are out of their control, like labor expenses, exchange rates and high costs at overseas factories.

“We focus on building strong relationships with key vendors,” he says. “That enhances our purchasing power and enables us to maintain fair market pricing for both our sales teams and our clientele.”

Click here for a PDF of the below infographic.