2020 U.S. Promotional Products Sales Revenue

$20.7 billion -19.8% decline

ASI Media’s annual State and Regional Sales Report typically takes the long view. But like with everything else, the pandemic has changed things. While the future still matters, at this moment distributors are concerned with the right here and now. Which states are opening up? What events are returning? Which markets are ready to buy?

That’s where our report comes in. Our exclusive data reveals which states and regions proved the most resilient for selling promo. Likewise, our reporting offers the strategies, products and trends that are going to propel distributors as the U.S. eyes perhaps a soaring economic expansion.

That would be a welcome relief after last year’s carnage. Each region declined by at least 18%. Promo powerhouses such as California (-22%), Texas (-14%), Florida (-14%) and New York (-26%) lost roughly $1.5 billion in promo sales combined. Unsurprisingly, no states had promo sales growth in 2020.

But enough bad news. Optimism abounds as distributors are anticipating strong sales and continued recovery the rest of the year. Use our guide to see what’s happening in your region – and why there’s reason to be excited. – C.J. Mittica

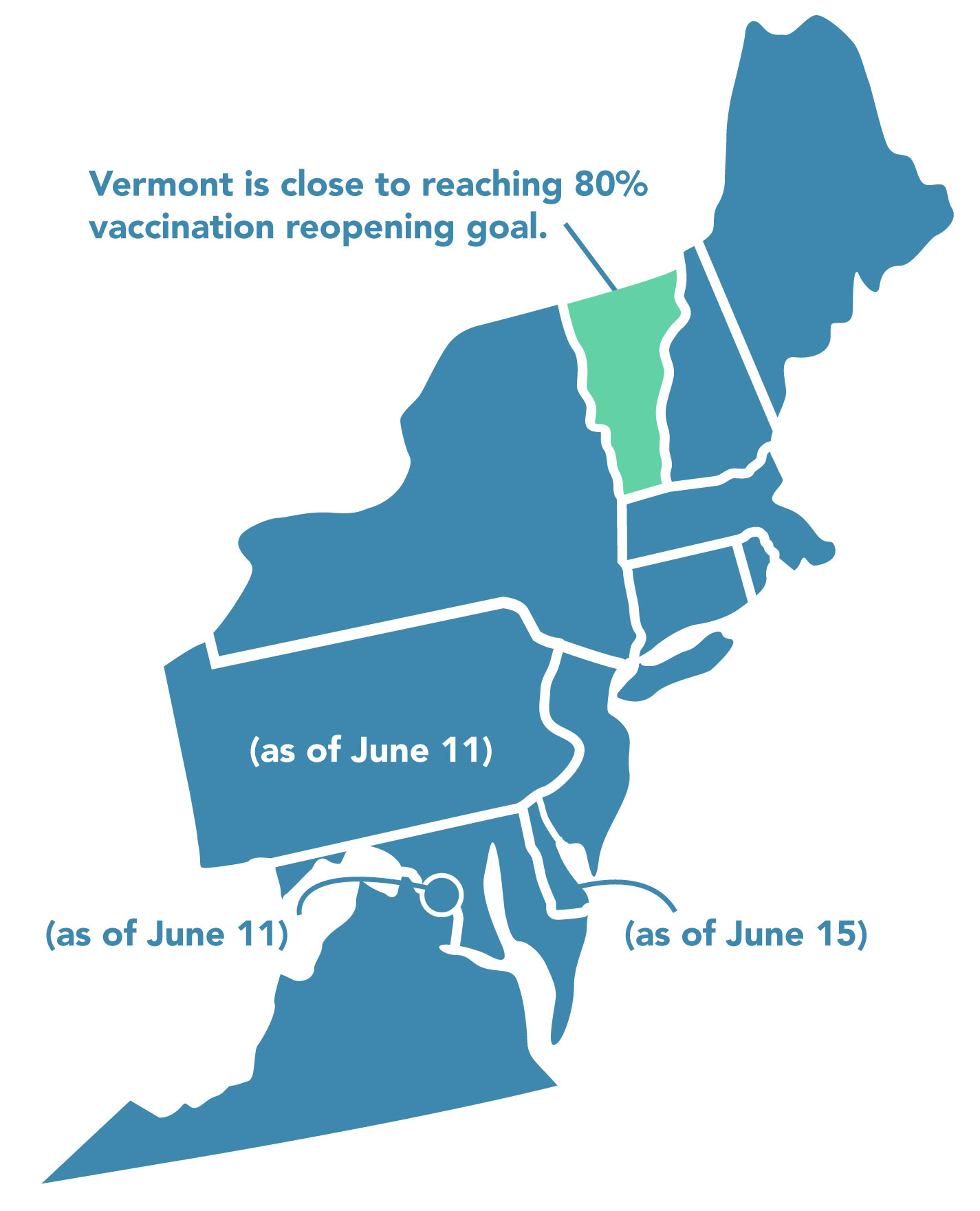

East

Sales are gradually recovering as distributors contend with protracted lifting of virus restrictions.

Business generally remains slow in the East, but promo firms report bright spots on the horizon as restrictions begin to lift ahead of the start to the summer season.

States in the area, from Maine to Virginia, saw an average sales drop of 22% between 2019 and 2020. Local business opportunity is improving but still sluggish as companies wait for officials in some states to lift COVID restrictions fully.

“Virginia’s opening, but we’re behind on vaccinations,” says Ron Baellow, president of Bright Ideas (asi/146026) in Troy, VA, about 20 miles east of Charlottesville. “And the governor’s a doctor! We weren’t as locked down as California, for example.” Just ahead of the long Memorial Day weekend, officials there finally announced a full reopening of the state, though masks are still required on public transportation, in healthcare facilities and in private businesses that require them.

It was a slow reopening process in Massachusetts as well, though the governor has just announced a full reopening without a mask mandate in order to expedite economic recovery. Chris Faris, CEO of Boost Promotions (asi/142942) in Beverly, about 20 miles north of Boston, says it was hard to plan when the timeline was lengthy and uncertain.

“We’re pretty optimistic here,” says Faris. “Reopening has been very conservative. Restaurants here have just been smashed, but I’m seeing more people on the roads and in the hallways in our office complex.”

Charles Doligé, a partner at New York City-based LR Paris (asi/246857), says his hometown of Washington, D.C., has more open offices than the Big Apple because of the number of government employees in the nation’s capital. Meanwhile, he and his team are having more in-person meetings in both locations, which is hopeful.

3 Hot Trends

“New York City is still very empty, and it worries me a bit,” Doligé says. “The Census Bureau found that more than 200,000 people moved out of Manhattan during all this. I was there a few days ago [in April] and it felt like there were a few more people out. We still have our headquarters in Times Square, but it’s been empty. I have to figure out what to do with it.”

New Jersey, which along with New York City was an early hotbed of the virus, is also gradually but cautiously opening up; the governor has lifted the mask and social distancing mandates for the fully vaccinated. “People really want to get back to in-person events,” says Andrew Nadel, co-CEO at Pride Products (asi/299307) in Springfield, NJ, about 20 miles west of Manhattan. “We work with mostly large law firms across the country, and half of the orders we’ve gotten recently were from them. They’re heading back to their offices more, and they’re getting ready for summer interns and associates.”

It’s been a tough year for Pride Products. The distributor brought in about $15.7 million in 2019, and in Q1 2020 was on pace to beat that number. But by the end of the year, it was down 40% from 2019 and had reduced its staff by nearly 75%.

“Restaurants here have just been smashed, but I’m seeing more people on the roads and in the hallways in our office complex.”Chris Faris, Boost Promotions

“In Q1 2021, we were way off from Q1 2020,” says Nadel. “We were doing $100,000 a week in 2019; now it’s $40,000 a week, though over the past six weeks we’re up to about $50,000. The last two weeks were great, but we’re a long way from where we were in 2019. This is the ‘hang in there’ year.”

Nadel says they’re finally starting to see some larger orders for golf shirts, North Face jackets, umbrellas and YETIs for upcoming events and employee gifts. In the meantime, the company’s virtual game hosting, a service they’ve called ConnectRship, has been helping them bridge business gaps. “We’ve done tournaments, corporate leagues, family game fests, new hire onboarding activities, partner retreats, alumni events, diversity events and staff appreciation,” says Nadel. “When a client isn’t ready to buy promo, this is something they might be able to do that keeps us in front of them.”

Baellow says Q1 was tough especially because of a lack of timelines. But now, with more dates for opening and a successful vaccine rollout, people are feeling more optimistic. “The vaccine changed attitudes,” he says. “So January and February were horrendous but March and April were very good.” He says about 40% of their clients are in higher education in the Mid-Atlantic region of the U.S., and the majority of them didn’t do any business with Bright Ideas for 14 months. But things are looking up.

“It’s starting to seem like normal,” says Baellow. “Funds are being released. The University of Virginia is planning for a full football stadium in the fall, but it depends on the virus and what the governor decides. They need ticket sales, but they don’t have the final say.”

One of LR Paris’ largest markets – hospitality – is finally showing signs of life as Americans travel domestically to luxury hotels for vacations. (Business travel, meanwhile, remains suppressed for the time being). “We’re working on new openings and loyalty programs right now,” says Doligé. “Most hotels opened in May, like in D.C. In the summer, they’ll start focusing on the global side of their operations.”

A solid vaccine rollout and a country with lots of travel options means the U.S. can recover more quickly than other countries, says Doligé, like his native France where LR Paris has an international office. “Business is really low over there. It’s not good,” he says. “They’re saying by mid or end of May everyone will be able to get vaccinated and the return to normal will be more like September.”

Even with optimism growing, there’s an elephant in the room: persistent supply chain disruption. Baellow is concerned about supply chain recovery not keeping pace with growing promo demand. “If the market goes crazy and we still have inventory challenges, it won’t be good,” he says. “There are also personnel shortages, rising raw material costs, lack of boats and not enough truck drivers to transport goods. We had Q4 blankets sit at port for 30 days last year. We’re already talking to clients about holiday gifts, because chances are their top three choices won’t be available.”

In the meantime, distributors in the Eastern region continue to look forward to a lifting of restrictions. Faris says with a clearer picture of reopening for nearby Boston, the entire region is coming back to life. “We just had two weeks with a massive influx of orders,” he says. “Q2 is going great and I think the rest of the year will be phenomenal. Q3 will be off the charts and Q4 will be a blowout because clients will spend their budgets on employees.”

At the moment, Boost is seeing big business from other regions of the country, like hotels and convention centers in Vegas at 92% room occupancy. But Faris is optimistic it won’t be long before the East looks that way too.

“We’re attending an in-person event in Atlanta in June that’s almost all sold out,” Faris says. “COVID won’t last forever.”

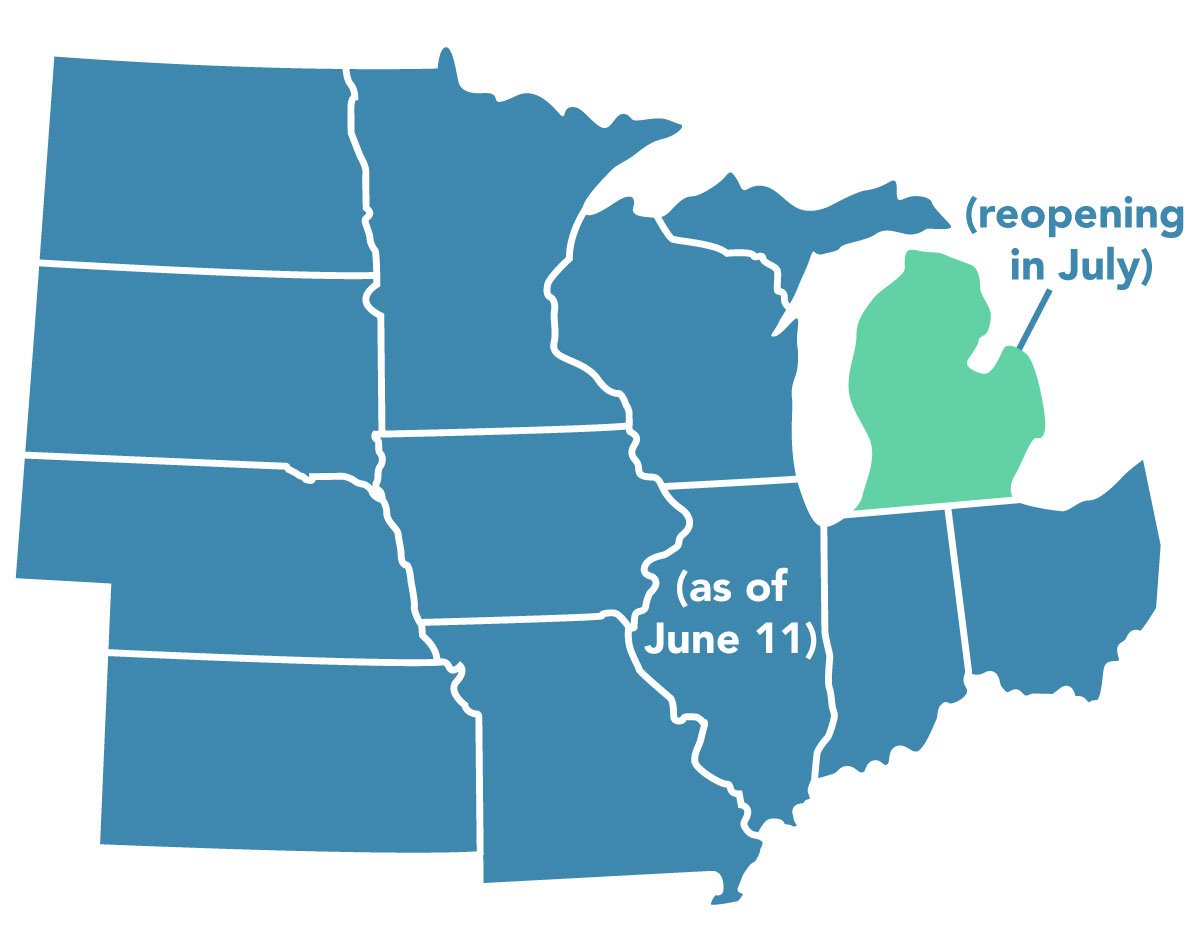

Midwest

From big races to trade shows, the return of major events is stoking optimism.

Distributors in the Midwest are bullish about 2021. Many states in America’s heartland have been reopening – and some never fully locked down to begin with. Events are also beginning to bounce back, though the demand for kitting, drop-shipping and higher-end gifting is still going strong, according to promo pros in the region.

“We’re slowly getting back into some normalcy,” says Tom Rector, CEO of Screenbroidery (asi/305623) in Indianapolis, IN. “It’s looking very positive that things will be happening, though it may be a little smaller scale.”

Indiana was home to the largest U.S. public event since lockdowns began, according to Road & Track: the Indy 500, held May 30. More than 100,000 fans attended the race, which was allowing 40% capacity at the massive venue. The ASI Show Chicago will be the first trade show in Chicago, held at McCormick Place from July 13-15. Soon after, the Chicago Auto Show, rescheduled from February, will take over the same venue, with electronic ticketing, timed entry and the addition of outdoor events – all to help control crowd capacity. Typically one of the largest auto shows in the country, this year’s car show will be cut to five days, rather than 10, attendance expectations accordingly moderated.

Distributors report that some of their clients are gearing up for summer concert series, and many marathons and 5Ks are moving forward with in-person races. “We’re seeing a lot of outdoor events coming back – a lot of golf tournaments,” says Julie Miller, owner of Rutabaga Rags (asi/315375) in Minneapolis, MN.

3 Hot Trends

In southwestern Ohio, happy hours at local breweries are packed, and outdoor markets featuring local small businesses have been popular, according to Yvonne Zeman, founder and CEO of Monarch & Co. (asi/275403), which has offices in Cincinnati and Denver.

Kansas took a very localized approach to shutdowns, allowing individual cities and counties to make calls on how to handle the pandemic. “We’re luckier than some other states,” says Janie Gaunce, CEO of Grapevine Designs (asi/212829) in Lenexa, KS. “Our governor really allowed decisions to be made at the local government level as to how much different areas closed down. Our area was open. … We always had people in the office with strict standards of protocol.”

Though large-scale events had been curtailed, as in other states, sporting events are returning – in baseball, for example, the Kansas City Royals boosted stadium seating capacity to 17,500 in May, up from 10,000.

“I don’t have any doom or gloom feelings about our industry. I think we’re going to end up with a huge year – maybe even better than 2019.”Julie Miller, Rutabaga Rags

Much like in 2020, the first half of 2021 has been all about kitting and fulfillment. “We turned into a wonderful home delivery service for our customers,” Gaunce says.

Throughout the pandemic, Rector says, Screenbroidery’s fulfillment department allowed the distributor to nab many new accounts it hadn’t been expecting. The company drop-shipped trade show kits, registration packets for races forced to go virtual and employee thank-you gifts. This year, he adds, “We’re still doing quite a bit of drop-shipping.” However, the focus is shifting toward employee recruitment. Asks Rector: “How do you share a box of your company culture for someone who’s not an employee yet?”

For example, an HR software company Screenbroidery works with sends out a box to new employees packed with custom board games, a plastic figurine of the company’s llama mascot, retail-inspired T-shirts with subtle branding and a copy of a book written by the CEO. “They do some really, really cool stuff,” Rector says.

Screenbroidery is also targeting the hospitality industry to offer recruitment and retention ideas, since so many restaurants and bars across the country are having issues attracting cooks, waitstaff and other positions.

Monarch has gotten more intentional with the fulfillment services it offers as well. Rather than include a low-end tee in a box, the distributor will suggest an eco-friendly, high-end option. Or if a client wants to include a food gift, Monarch will use a site like Faire.com to find small businesses local to intended recipients or search for purpose-driven or minority-owned options – points of interest that can be included in print materials, giving the kit more social impact and telling a more compelling brand story.

That approach has resulted in some heart-warming instances, such as when Monarch gave one of the small minority-owned businesses it worked with its biggest sale ever. “They reached out and asked us if it was a real order,” Zeman says. “It’s exciting to be able to say that something I created is having an impact on someone else.”

As a whole, promotional products distributors in the Midwest saw a 23% drop in sales year-over-year in 2020, according to ASI research – the largest drop of any region. Individual experiences varied, however. Grapevine Designs ended 2020 10% higher than the previous year, and so far in 2021, the distributor is up about 57% year over year. “Grapevine is having a good year again, knock on wood,” Gaunce says.

Screenbroidery ended last year 20.61% ahead of 2019, according to Rector, and 2021 is looking just as positive. “When we got into the fourth quarter of 2020, it got nuts for us,” he adds. “October, November and December were by far the best months we’ve ever had, and it hasn’t stopped since.”

Chicago-based Top 40 distributor Zorch Inc. (asi/366078) had a rough 2020 – particularly because CEO Mike Wolfe didn’t want to dilute the brand by dabbling in PPE – but 2021 is looking up, he says. As of April, the distributor is up 72% year over year. “We’re trending significantly up from last year as accounts start to resume more stable ordering patterns,” Wolfe adds.

Overall, Midwestern distributors expressed optimism and enthusiasm for the second half of 2021. Wolfe believes the promo industry can potentially return to about 90% of the revenue it made in 2019, with the opening up of more large-scale events.

Miller of Rutabaga Rags was even more positive, noting that staying top of mind with clients and presenting creative solutions always pays off. “I don’t have any doom or gloom feelings about our industry,” she says. “I think we’re going to end up with a huge year – maybe even better than 2019.”

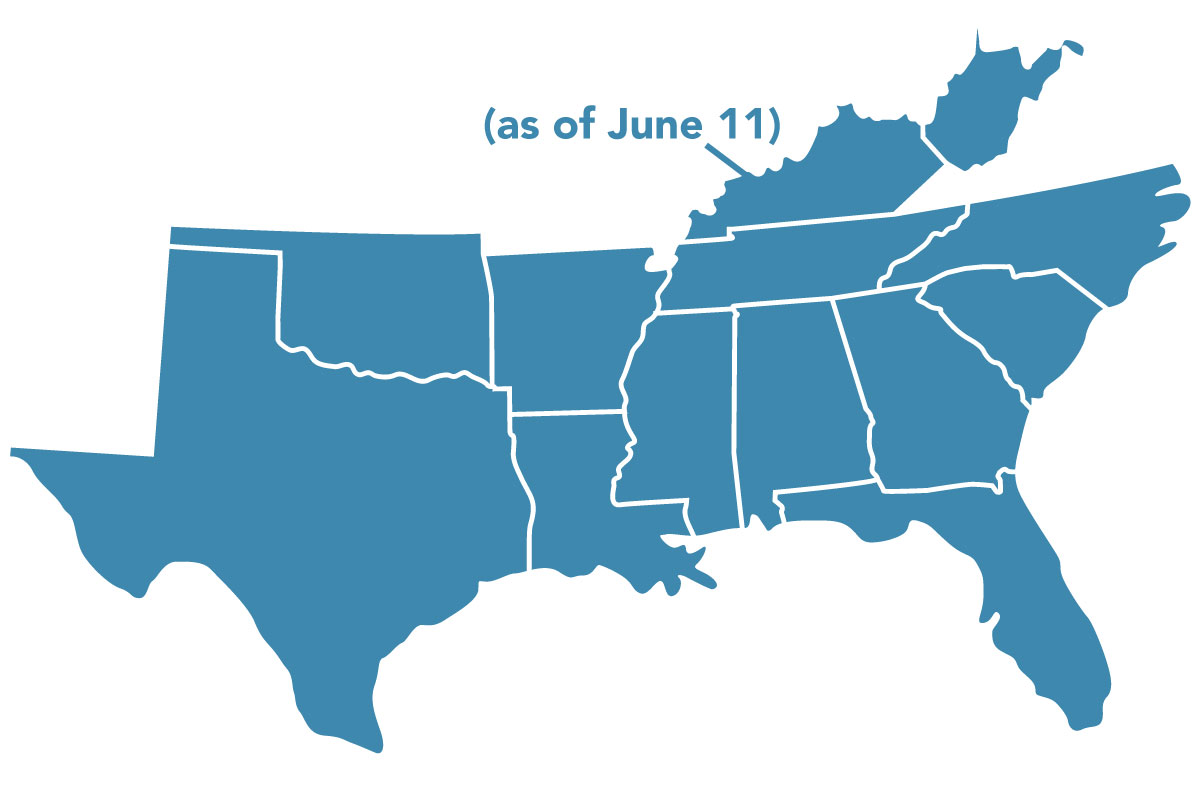

South

The biggest region for promo sales is seeing momentum building.

Things are looking up down South.

Just ask Matt Gledhill. The vice president of sales and marketing at San Antonio, TX-based Walker Advertising (asi/354440) recently produced an order of 20,000 T-shirts that had a message on the back saying the client, a convenience store chain, was hiring. The order was a nice score for Gledhill. The fact that it centered on a client’s mass hiring initiative speaks to how the economy is gaining steam in the South. “It’s a wonderful sign for me, my client and the areas they service,” he says.

Broadly speaking, Gledhill’s optimistic assessment is shared by distributors across the South. While the situations for individual markets, companies and states vary, the South remains the most wide open of all the regions when it comes to reopening and restoring capacity levels. And while promo sales might not yet be cranking at pre-pandemic levels region-wide, there’s nonetheless a feeling that the South’s economic engine is revving up and that promo firms are poised to produce a 2021 that’s more prosperous than the COVID-ravaged year prior.

“We’re rounding a corner,” says Maggie Wright, director of sales and marketing at Birmingham, AL-based City Paper Company (asi/162267). “We absolutely see 2021 gaining momentum in Q3 and Q4 as companies continue to welcome back employees and begin to bring back trade shows, conventions and events. We see that people are eager and excited to get back out there and we anticipate that this will impact the promo industry very positively.”

For Luke Freeman, business is already starting to boom.

“Since the vaccine rollout began, so have all the quote requests. Q2 activity is right back to what 2019 was,” says Freeman, president/founder of distributorship Wizard Creations (asi/362568), which has offices in South Florida and Nashville, TN. “Our pipeline and number of deals have increased dramatically.”

3 Hot Trends

The South is promo’s powerhouse – the region where distributors generate the most revenue. While distributors’ annual sales in the South dropped 18% in 2020 compared to 2019, the region still tallied $7.81 billion in revenue – nearly double that of the Midwest and over $3 billion more than both the West and East. Indeed, the South accounted for nearly 40% of distributors’ overall $20.7 billion in sales last year, ASI data shows.

Southern promo firms are eager to keep that pole position. The savviest among them are strategically courting clients and markets they believe are poised for growth in the region.

“Building supplies is one vertical that has been up big for us so far in 2021, with the housing market so tight and COVID DIY-ers going gangbusters with home improvements,” says Robert Fiveash, co-president of North Carolina-headquartered Brand Fuel (asi/145025). “Technology, real estate, healthcare and colleges/universities should all see nice growth through the rest of 2021, too.”

Hopkinsville, KY-based Williams Advertising (asi/360402) is continuing to work closely with essential businesses, including utilities, healthcare institutions, banks and education clients. “We’re helping them brand and communicate, and also support their staff and their customers,” relates owner Sarah Whitaker.

“We absolutely see 2021 gaining momentum in Q3 and Q4 as companies continue to welcome back employees and begin to bring back trade shows, conventions and events.”Maggie Wright, City Paper Company

Williams Advertising has also been busy enabling small businesses to get new revenue streams flowing by selling branded merchandise. “We’re beginning to see event merchandise needs too,” Whitaker says.

Dallas-based Bob Lilly Promotions (asi/254138), along with others like City Paper, has been winning ample business with clients in the transportation/logistics market – something CEO Bob Lilly Jr. expects to continue given the ongoing need for delivery services and the like. “We’ve also invested in various licenses in the past several years,” Lilly notes, “which we think will result in big opportunities with, for example, NFL teams and sponsors.”

Also driving sales at City Paper is their retail clients’ need for custom packaging as a result of more online shopping. Interest is rising too from retailers and manufacturers that are growing and trying to hire. Home mortgage and financial industry companies have been investing steadily in promo as well. “We’re optimistic that we’ll continue to see an uptick,” says Wright.

The Georgia-based husband-and-wife team Jay and Jill Harman of Top 40 distributor American Solutions for Business (ASB, asi/120075) is also uncovering gems in the financial market. While certain financial clients aren’t spending on customer-facing initiatives as they did before the pandemic, there have still been choice opportunities, including a multimillion-dollar project that involves providing a gamut of solutions, including employee stores and warehousing/distribution, the Harmans explain.

Back in Texas, Gledhill hits on a common theme when he identifies another key market. “Alcohol has been huge,” he says. “My clients in this industry had great sales in 2020 and it’s continuing this year, which is good for us. I’m sure there will be plenty of celebrating in 2021, which will only give these clients more marketing budget.”

While momentum is building, southern distributors are continuing to contend with some headwinds from COVID. “I’m most concerned that some clients’ budgets will continue to be on hold,” says Freeman, citing an oft-mentioned worry.

Other distributors noted that sales of personal protective equipment, which accounted for billions of dollars in distributor revenue in 2020, have dropped off dramatically. “I’ve designed a few masks in the last couple months but the business has mostly disappeared,” shares Gledhill. Opinions are generally divided whether there will be enough strength in distributor sales of more traditional promo products in 2021 to make up for the diminished PPE business.

Meanwhile, some distributors note that end-clients in niches that were especially hard-hit by COVID restrictions are still suffering, putting business with them on hold.

“Unfortunately, the cruise industry, while open in some areas, is still not allowed out of U.S. ports,” explains Danette Gossett, owner of Miami-area Gossett Marketing (asi/491973). “The trickle-down effect to the economy is widespread. Not only did we previously help promote the cruise lines, we also worked with companies that had large groups or full ship charters ‘brand’ their experience. None of that’s happening right now.”

A universal issue distributors in the South – and elsewhere – are dealing with is lack of inventory and delays on production and fulfillment from suppliers. Inventory problems, along with increases on some products, are a consequence of supply chain disruption that’s the result, in significant part, of lack of adequate shipping/shipping container availability, port congestion and domestic transportation delays. Prices on products have increased too, as the cost of shipping/transportation and raw materials have soared.

“The supply chain is severely damaged in our industry, as well as many other industries, which makes doing business more difficult and expensive,” says Lilly.

Those challenges are likely to remain thorns in the months ahead. Nonetheless, the general consensus among southern distributors is that the promo industry’s business in their region is poised for a bountiful summer and beyond.

“I’m optimistic about the future,” says Gossett. “Many segments have already exceeded pre-COVID revenues. As this continues, other sectors will increase their optimism and their spending. We will come out of this pandemic era with better business practices and ultimately better businesses.”

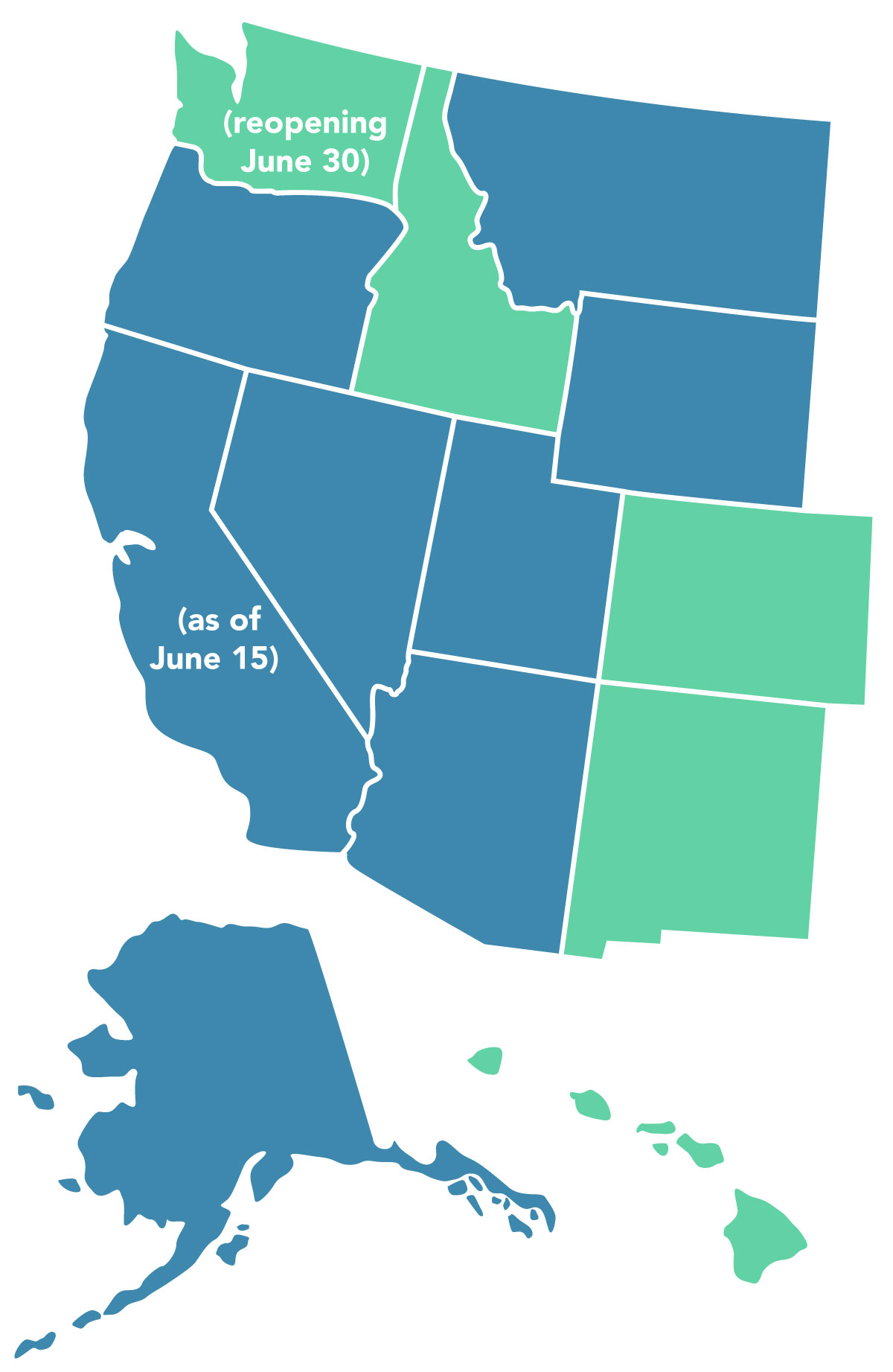

West

A fast-growing region before the pandemic is rediscovering its old ways.

The West is finally seeing light at the end of the tunnel.

As mass vaccinations increase and government-imposed restrictions loosen, many states are returning to some semblance of normalcy. Restaurants, stores and hotels are seeing increased activity after months of being either shut down or capped to limited capacity. As a result of their newfound freedom, they’re reconnecting with promotional products distributors, eager to get their brand back at the top of their customers’ minds.

“We’re seeing an uptick in business, slowly but surely,” says Eddie Brascia, president of Santa Rosa, CA-based Sonoma Design Apparel & Promotions (asi/329869). Due in part to its population, California has had more COVID cases than any other state, and Governor Gavin Newsom instituted broad regulations and tight restrictions to combat the spread of the coronavirus.

Sonoma Design has stayed busy by targeting the state’s copious wineries, providing neck gaiters and name-brand apparel like Patagonia. “Once we fully open, we’re hopeful we’ll see a ton of tourism,” Brascia says. “If that’s the case, we should end the year pretty strong. Not 2019 strong, but definitely better than 2020.”

California had the third largest percentage decrease in promotional products sales last year, with a decline of 22%. The only two states that fared worse in the region were greatly impacted by lack of vacationing: Hawaii’s promo revenue dropped 30% to $65 million and Nevada’s was down 24% to $205 million.

While travel and tourism suffered, construction has remained a strong market, especially residential housing, as the West increasingly holds more of the country’s population (it’s now up to 24%). The Wall Street Journal/Realtor.com Emerging Housing Market Index, which relies upon a slate of housing market and economic vitality metrics, ranked five Western cities in its top 10 list. Coeur D’Alene, ID, took the top spot.

The demand is being driven by historically low interest rates and the transition to working from home, allowing more flexibility in where people live. Between February 2020 and February 2021, average home values in Colorado Springs, CO, and Bozeman, MT, rose by 15% and nearly 20%, respectively. In Boise, ID, house prices are up by 28%, the biggest increase among the 900 metro areas tracked by Zillow, an online listings platform.

3 Hot Trends

While already boasting densely populated markets like Los Angeles, Phoenix and San Francisco, the West also claims some of the nation’s fastest-growing large cities, such as South Jordan, UT, Buckeye, AZ, Meridian, ID, and Irvine, CA, according to U.S. Census Bureau data. Millennials and Gen Z are fueling much of the residential surge. In fact, Utah, Montana, Washington, Idaho, Colorado and Arizona are six of the top 10 most popular destinations for young professionals to move, according to a U.S News & World Report analysis.

“With more people getting vaccinated, things will continue to open up more for events and gatherings, which is good for business.”Chance Castellucio, PromoLeaf

Utah, which topped the list, saw its population grow by 18.4% over the past decade, making it the fastest-growing state. While that’s led to plenty of opportunity from local clients, the Beehive State has also been generating interest from companies throughout the country. “Salt Lake City has been marketing itself as ‘open for business,’ booking a ton of conventions for the summer,” says Chance Castellucio, executive vice president of sales at Park City, UT-based PromoLeaf (asi/300534). “With more people getting vaccinated, things will continue to open up more for events and gatherings, which is good for business.”

While weather, recreational options and other quality-of-life factors undoubtedly contribute to the West’s appeal, so too does the region’s general economic health. Measuring states’ economic stability and potential, U.S News & World Report listed Washington at the top of its Economy Rankings in its annual “Best States” report. The Evergreen State, however, wasn’t alone in representing the West, as Utah and Idaho also claimed top 10 spots.

Representing a large portion of the region’s markets, sports have finally made a comeback on all levels – professional, college, high school and youth. That’s been a boon to distributorships like Laurel, MT-based Dynamic Designs (asi/184676). “Spring sports picked back up, so we’ve sold lots of apparel and caps,” says Don Smarsh, owner of Dynamic Designs. “Traditional promotional products are still a little down, but by fall, I think things will be good.”

The West also has favorable business climates that continue to prompt new business ventures even during the pandemic. In the Tax Foundation’s 2021 State Business Tax Climate Index, an annual report examining each state’s business-friendly qualities, Western states claimed five of the top 10 slots, with Wyoming topping the list.

In addition to seeing clients thrive in the financial and service markets, Chandler, AZ-based Stowebridge Promotion Group (asi/337500) has experienced tremendous growth over the past year, doubling the size of its business. “We were fortunate that we’ve always invested in production capability so when suppliers couldn’t ship, we had many offerings we could print or make right here,” says Kathy Finnerty Thomas, president of Stowebridge. “We continue to produce a lot of kitted projects, but we’re also seeing a modest return of outdoor events, such as bike races.”

Stowebridge was also fortunate that Arizona didn’t follow the same restrictions as other states. Although there were stay-at-home orders for roughly six weeks, they weren’t enforced and there were many exceptions. Furthermore, Governor Doug Ducey allocated $4 million of federal CARES Act funding to the Arizona Office of Tourism.

“There are many more Arizonians who have taken this seriously,” says Thomas, referring to the pandemic. “Fortunately, we have done well with vaccinating those who want it.”